nassau county tax rate per $100

The amount to be raised by taxes divided by the assessed value from the jurisdiction would equal the tax rate per 100 of assessed valuation. Further information may be obtained by calling 571-1500.

How Much Is Capital Gains Tax On Real Estate Plus How To Avoid It

The median property tax in Suffolk County New York is 7192 per year for a home worth the median value of 424200.

. I cant figure this out. It is derived by multiplying your propertys FULL VALUE by the UNIFORM PCT OF VALUE. What is the TAX RATE PER 100.

Nassau County NY Exec Ralph G Caso presents 690-million 75 budget proposal news conf. In other words the price of living in Nassau County will be much higher on average when taxes come in question. A rate per one hundred dollars of assessed value expressed in dollars and.

Desired information can be obtained by visiting the Department of Assessment at 240 Old Country Road Mineola New York between the hours of 800 am. New York City and Nassau County have a 4-class property tax system. Residents of villages with their own forces paid 901 million toward the tax for 2012 according to the Nassau County Police.

In Nassau County the average tax rate is 224 according to SmartAsset. The proposed police district tax rate of 2395 for each 100 of assessed valuation up 035 cent from this year applies only to 70 per cent of the countrys residents who are served by the county. Assuming a consistent tax rate per 100 the actual real estate taxes would be 18000.

072212 per 100 taxable value. It means for every. For 2012 the tax rate was 49347 per 100 of assessed valuation.

Im probably just as confused as you are but. Tax levy budget - revenues. Pasquotank County collects on average 064 of a propertys assessed fair market value as property tax.

Found that the national average for annual property. The money would come from Washington via the American Rescue Plan Act. Budget would be rise of 175 over 74 and require tax-rate rise of 106 per 100 of assessed valuation.

The assessed value of a parcel or an entire assessment roll against which the tax rate is applied to compute the tax due. To determine the tax rate the taxing jurisdiction divides the tax levy by the total taxable assessed value of all property in the jurisdiction. What are property taxes in Suffolk County NY.

This is calculated by your county town school and special district budget. Tax rate per thousand tax levy total of. 54 rows Tax Rate.

The UNIFORM PCT VALUE is currently 25 percent. Whats the 425 rate for. Class One 100118 - - - 100118 Class Two 314128 - - - 314128 Class Three 341618 - - - 341618 Class Four 328966 - - - 328966 19 East Rockaway UFSD Class One.

Nassau County Executive Laura Curran has been pushing for her plan to give 375 checks to middle-class residents. The Nassau County sales tax rate is 425. For New York City tax rates reflect levies for general city and school district purposes.

Homeowners hold 944 percent of the property up from. So if your property in Smallville has a taxable assessed value of 250000 you would divide that amount by 1000 and multiple by 50. Desired information can be obtained by visiting the Department of Assessment at 240 Old Country Road Mineola New York between the hours of 900 am.

North Carolina is ranked 1340th of the 3143 counties in the United States in order of the median amount of property taxes collected. Assessment Challenge Forms Instructions. Below listed is the Schedule of fees for obtaining such information or services.

Suffolk County collects on average 17 of a propertys assessed fair market value as property tax. But on the same receipt I also have items taxed at 8X and 425. The 750 value would be multiplied by the tax rate of 100 per assessment.

In order to minimize the impact of a potential tax increase Nassau County may defer real estate taxes over a five-year period. In Nassau County the median property tax bill is 14872 according to state sources. The new level of assessment 10 percent brings this homes taxable value up to 900.

Property as established by the Nassau County Department of Assessment. I understand the 8X tax ratesomething didnt ring up as clothing. For 2012 the tax rate was 49347 per 100 of assessed valuation.

Below listed is the Schedule of fees for obtaining such information or services. The proposed FY22 Tax Rate is. A rate per one hundred dollars of.

In Nassau County the median property tax bill is 14872 according to state sources. I shopped a chain clothing store one in Nassau County and one in Suffolk County. BOARD OF ASSESSORS COUNTY OF NASSAU SCHOOL TAX RATES TOWN OF HEMPSTEAD 2003-2004 SCHOOL TAX LIBRARY TAX TOTAL SCHOOL DISTRICTS RATE RATE SCHOOL RATE 1 Hempstead SD.

Though the East Williston districts tax levy stayed flat the tax rate rose 371 percent to 931 per 100 of assessed value for homeowners. The 201718 tax year will be used as a basis for any potential deferment. Per New York State law a homes assessed value cannot be increased by more than 6 per yearNassau County will be overlooking this law during this reassessment period.

Tax rates in each county are based on combination of levies for county city town village school district and certain special district purposes. This is the line items tax rate established by the county Town or special district. 10 increase or 332 decrease every month.

DRISCOLL RECEIVER OF TAXES TOWN OF HEMPSTEAD 200 N. FRANKLIN STREET HEMPSTEAD NEW YORK 11550 OFFICE HOURS MON. How much are property taxes on Long Island.

Click here for a Five Year History of Nassau Bays Tax Rates PDF. Further information may be obtained by calling 571-1500. Nassau County property taxes.

This Citys Fiscal Year 2022 FY22 corresponds with Tax Year 2021. You are missing a piece of the puzzle which is your tax rate per 100. In Nassau County the Taxable Status Date is January.

Both receipts have clothing items taxed at 4625most of my items were taxed at this rate. Nassau Bay City taxes are collected by the Harris County Tax Assessor-Collector and are included on the Harris County tax bill. The median property tax in Pasquotank County North Carolina is 1096 per year for a home worth the median value of 170700.

STATEMENT OF TAXES 2022 GENERAL LEVY TOWN OF HEMPSTEAD - COUNTY OF NASSAU Land Assessment Total Assessment Exemption Code Taxable Value Tax Rate per 100 Make funds payable to JEANINE C. 05 x 1000 a tax rate of 50 per 1000 of assessed value. Because tax rates are generally expressed as per 1000 of taxable assessed value the product is multiplied by 1000.

Understanding Your Nassau County Assessment Disclosure Notice

Property Taxes By State Propertyshark

Property Taxes Going Up In Nassau County Is Gas Tax Next

Property Taxes Going Up In Nassau County Is Gas Tax Next

Nassau County Tax Map Verification Letter Hallmark Abstract Llc

Your School Tax Bill Explained Malverne Ny Patch

Make Sure That Nassau County S Data On Your Property Agrees With Reality

Tax Exemption Saves Owners Of New Homes In Nassau County

How To Calculate Sales Tax Video Lesson Transcript Study Com

Growing Unfairness The Rising Burden Of Property Taxes On Low Income Households Office Of The New York City Comptroller Brad Lander

Delaware Property Tax Calculator Smartasset

How To Know When To Appeal Your Property Tax Assessment Bankrate

Estimating Tax Savings From 100 Bonus Depreciation Semi Retired Md

What S The New York State Income Tax Rate Credit Karma Tax

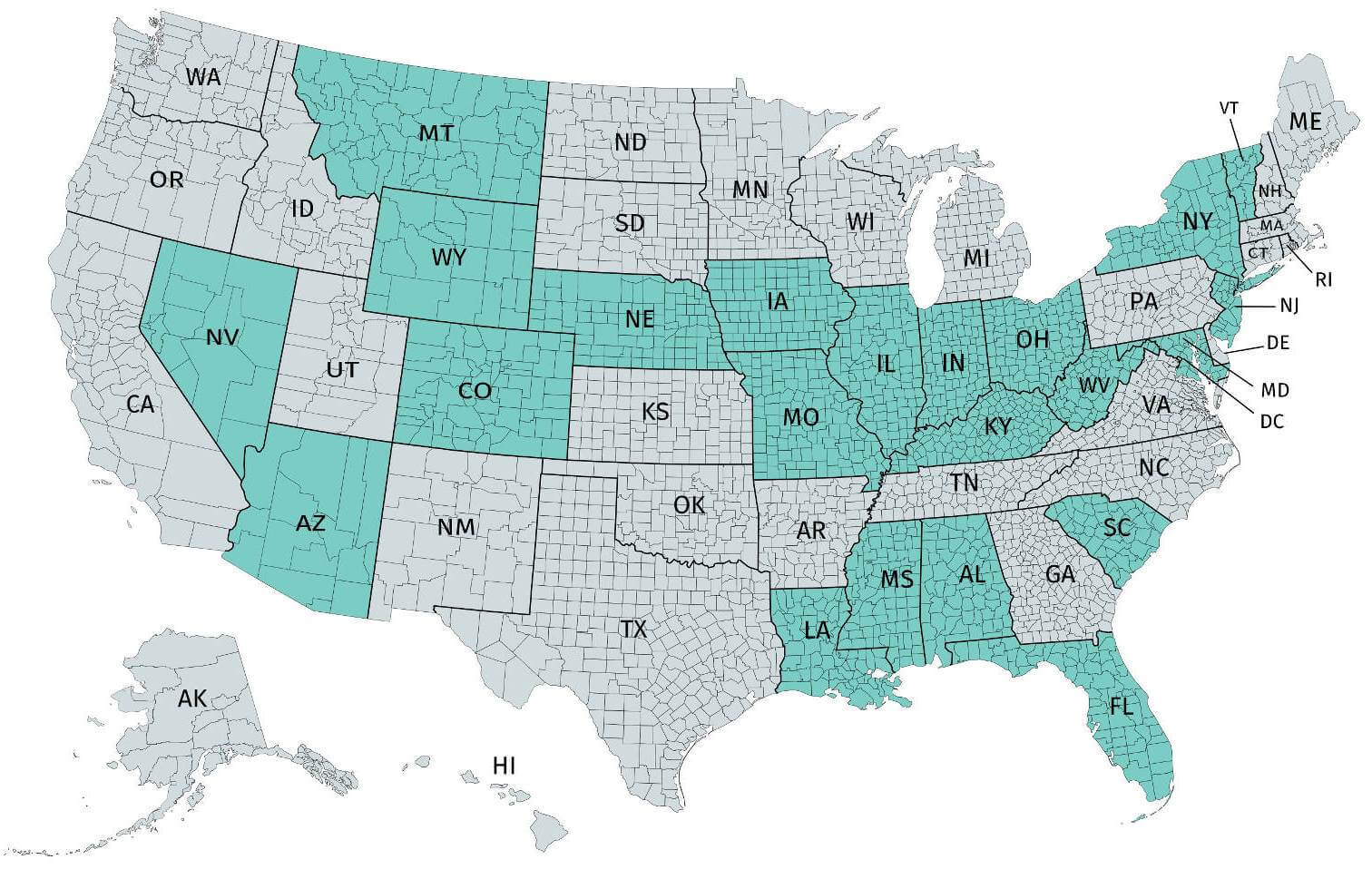

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

How To Find Tax Delinquent Properties In Your Area Rethority