defer capital gains tax canada

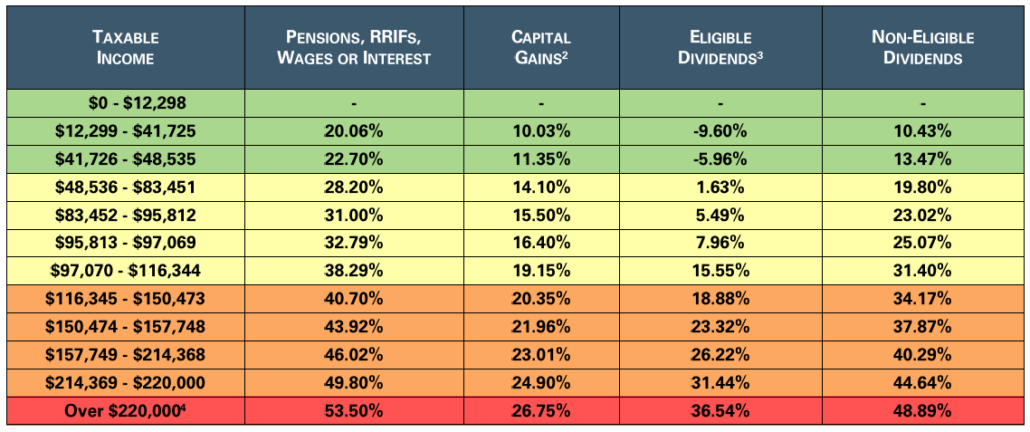

There are only fifty-percent taxes on capital gains in Canada which means of 100000 fifty percent will be taxable meaning 50000 will be taxedYour 50000 personal use property tax liability is fully taxable at the individual level plus your taxable income is taxable under each tax bracket. There are a few ways to avoid or minimize your capital gains tax in Canada.

Capital Gains Tax Calculator For Relative Value Investing

So if your spouse bought 100 shares of ABC stock and then transferred them to you in the divorce neither of you will have to pay capital gains tax on it at that time.

. Since 2001 all capital gains are taxable in Canada at the rate of 50 implying that if you have a capital gain of say 100000 on the sale of capital property you are required to include only 50000 in your income tax return for the. And in Quebec someone with 150000 of income will pay about. Section 44 applies to a property that.

375000 gain deferral since he is reinvesting three-quarters of his proceeds. However in this scenario he is only deferring half of the gain as 250000 was not reinvested in the new property and will be. In our example you would have to include 1325 2650 x 50 in your income.

If the funds remain in the QOF after the tax on the gain has been paid then the basis is equal to the amount of the original deferred gain. The inclusion rate for personal and business income is 100 meaning you need to pay taxes on all of your income. Replacement property may occur for a number of reasons including.

Capital gains deferral for investment in small business Eligible small business corporation shares Calculating the capital gains deferral ACB reduction Other transactions Property included in capital cost allowance Class 141 Partnerships Purchase of replacement property. Keep eligible assets in tax-sheltered registered accounts such as Tax-Free Savings Account TFSA and Registered Retirement Savings Plan RRSP. Click here to add your own comments.

The inclusion rate is 50 so you add half of that gain 558308 to your total income for the year. Capital gains deferral B x D E where B the total capital gain from the original sale E the proceeds of disposition D the lesser of E and the total cost of all replacement shares. The amount of tax youll pay depends on how much youre earning from other sources.

Claiming this reserve will allow the deferral of capital gains for a maximum of five years. By filing the replacement property election he believes that he will be deferring tax on three-quarters of the gain on sale ie. Deferral election is not taken but can claim CCA Without the deferral election the appreciation of 250000 from Year 1 to Year 5 is taxable in Year 5 even though you didnt truly sell the property.

However the Canada Revenue Agency CRA allows Canadians to defer capital gains on capital property sale using the capital gains reserve discussed below. Use capital losses from previous years or this year to offset your capital gains fully or partially. The taxable portion of 125000 250000 capital gain x 50 inclusion rate is taxed at your marginal tax rate.

Replacement property tax rules permit farmers to defer capital gains tax until the subsequent disposition date of the newly purchased property. How Do I Postpone Capital Gains Tax. Here are six creative ways to defer a tax bill until a future year.

The capital gains inclusion rate is 50 in Canada which means that you have to include 50 of your capital gains as income on your tax return. Capital gains realized by investors are currently subject to tax on only half of the gain. You would defer the long term capital gains tax until April 15 2027 and get earn a small tax reduction at that time and if you held the QIZ fund for at least 10 years you would be able to cash out of the fund 100 tax free.

So if you buy a stock for 100 and sell it for 150 a few years later your capital gain is 50 less commissions or other expenses and you have to pay tax on that amount. In Canada taxpayers may defer and roll capital gains into replacement properties under either section 44 or 441 of the Act. The permitted deferral of the capital gain from the disposition of eligible small business corporation shares is determined by the following formula.

I Has been stolen destroyed or expropriated often referred to as an involuntary dispositionor. In Canada can you defer capital gains tax by re-investing the capital gain back into more real-estate like they are able to do in the States. A 100000 capital gain for someone with 75000 of other income in Ontario will generate about 18930 of tax payableunder 19.

This article briefly explains the treatment of capital gains deferral for investment in small businesses under the Canadian tax law. As long as you are a resident of Canada you can claim the capital gains reserve. If the funds are left in the QOF for at least seven years the basis increases again to 15 of the deferred capital gains.

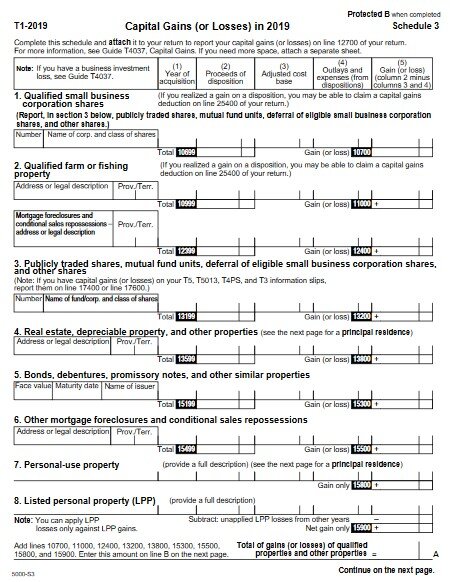

Thus 15 of the original gain is tax-free. To claim this reserve form T2017 in schedule 3 must be completed and submitted with your personal tax return for the year of sale. Comments for Deferal of capital gains tax in Canada.

In a nutshell you. Defer capital gains You can defer paying capital gains tax for your shares only when you got them from a spouse or parent due to death or divorce. Canadian Owning US Property As a Canadian if you own an eligible property in the US you can leverage the 1031 exchange for US tax purposes.

In Canada 50 of the value of any capital gains is taxable. You deduct your exemption of 883384 to get a 1116616 taxable capital gain. The election provides farmers with the opportunity to not incur a tax liability immediately at the time of the sale transaction.

The good news is that. This is a grave mistake that could lead to bad tax consequences. Claim a capital gains reserve If you sell an asset at a profit its possible to.

Whether realized corporately or personally capital gains currently have an effective tax rate around 26 at the highest marginal rate 240 in Alberta 2675 in BC and 2676 in.

Tax Tips 2016 Investment Income Capital Gains And Losses Capital Gains Tax Canada

Tax Planning Strategies For Real Estate Investments Elevate Realty

Capital Gains Tax In Canada 2022 50 Rule Fully Explained

Investment Income Taxation Intelligent Design Or Jurassic Park Physician Finance Canada

Pay Less Tax On Your Capital Gains The Independent Dollar

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

Complete Guide To Canada S Capital Gains Tax Zolo

Taxation Of Investment Income Within A Corporation Manulife Investment Management

How Capital Gains Tax Works In Canada Forbes Advisor Canada

Defer Capital Gains Tax When To Pay Taxes Manning Elliott

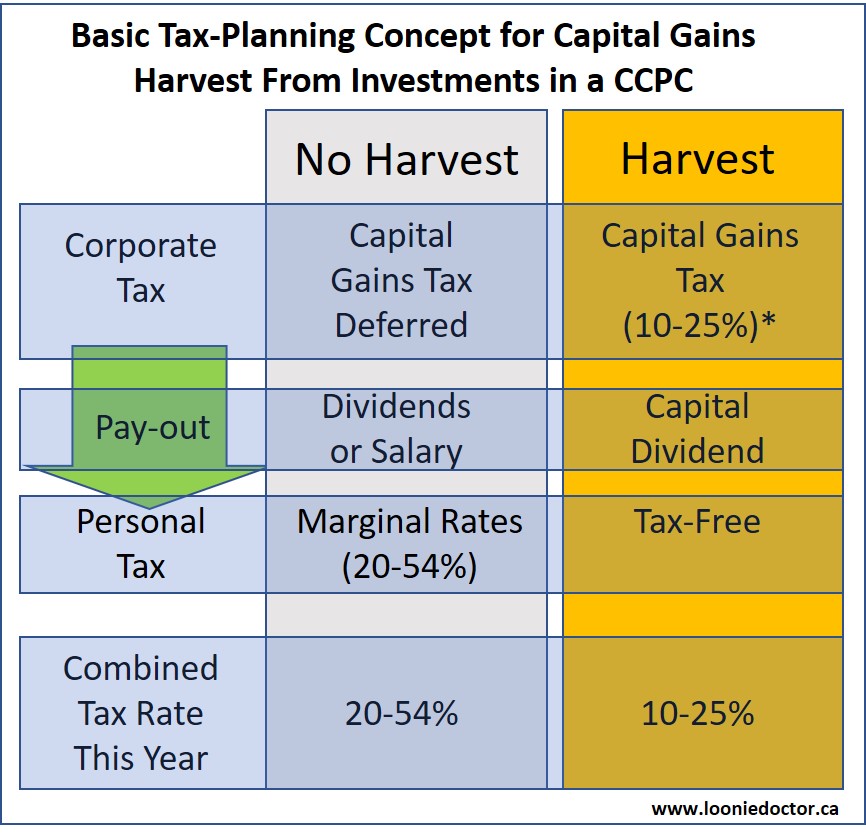

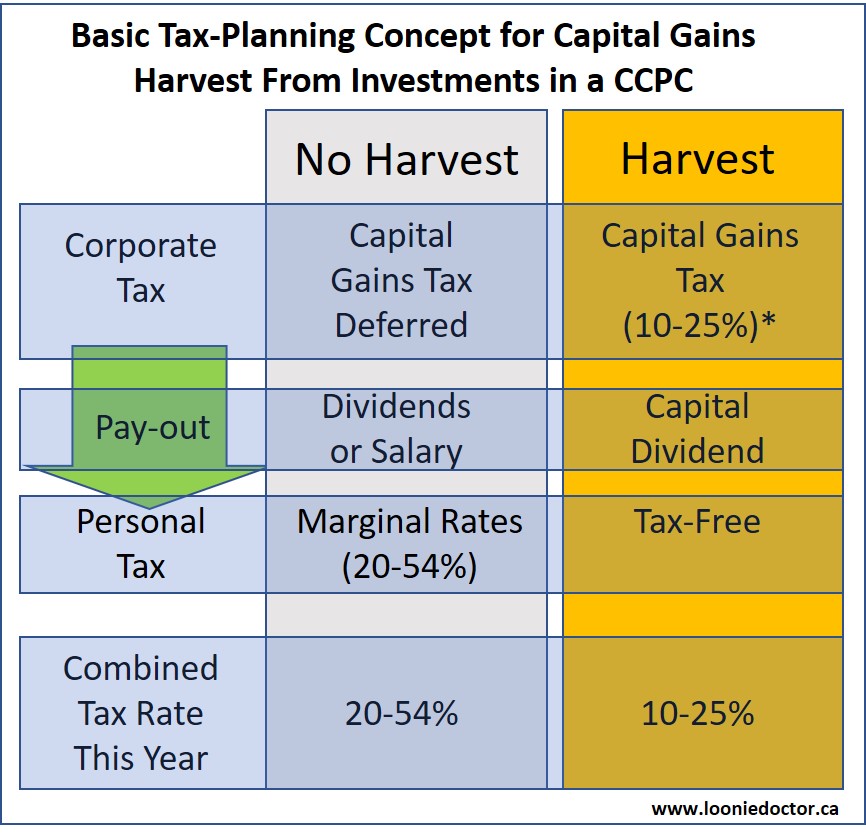

Time For Capital Gains Harvesting From Your Corporation Physician Finance Canada

5 Categories Of Tax Planning Alitis Investment Counsel

Tax Tips 2016 Investment Income Capital Gains And Losses Capital Gains Tax Canada

How To Defer Capital Gains Tax On Real Estate Sales Madan Ca

How To Avoid Capital Gains Tax On Real Estate Canada Ictsd Org

Time For Capital Gains Harvesting From Your Corporation Physician Finance Canada

Claiming Capital Gains And Losses 2022 Turbotax Canada Tips